The Trendline Pro Trader (TPT) is a new trading tool implemented as a trading strategy designed exclusively for the NinjaTrader 8 platform. Trendlines are manually placed and armed based on observed horizontal or diagonal support and resistance levels or using your most favored indicators. Once put in place, the trendline(s) can be activated individually or as a group and they will be displayed as solid lines. TrendlineProTrader will automatically trigger the trade upon the break of the trendline and exit the trade based upon your predefined position management settings or another trendline that you can customize.

Once a trade is initiated, the position will be automatically managed using dynamic exit logic and/or profit targets or stop loss orders as well as rules that modify the stop such as breakeven and trailing stops. There are even daily equity stops that will halt trading once a certain equity level is reached for the day

Demo Video – Click Full Screen for Best Viewing

Diagonal Breakout

This is the most common type of breakout pattern where the green trendline is positioned along swing highs for a long and along swing lows for a short when the trendline is broken. Initially, trendlines on the chart are dashed signifying they are inactive and ready to be positioned. When one trendline is triggered, the other active trendline is deactivated.

Horizontal Breakout

This is a great technique to take advantage of range-bound markets whereby an activated trendline can be placed above and below a tight price consolidation without the need to commit to one direction or the other. Once the market breaks in one direction, the opposite trendline is disarmed and the open position is managed automatically.

Channel Surf

This technique exploits the nature of the markets to oscillate and revert back to the mean. Instead of initiating an entry in the direction of the breakout, this technique will sell when the price action reaches the magenta trendline at the top of the price range and buy when the price action reaches the blue trendline at the bottom of the pirce range.

Jump on Trend

Sometimes, when the market is on the move, the price action is so good you want to get in now. Buy and sell at market buttons are available to facilitate immediate entry in to the market and the embedded position management functionality will help reduce risk and let profits run. No need to use a separate account or DOM to initiate your manual trade.

Trailing Stop Exit

Once a position is taken and after a specified profit trigger is achieved, a trailing stop can be used to trail trending price action and protect profits. When using multiple lots, some lots can be used to take profit at a specified target while the last lot can be used enable a runner to capture profits on extended trend moves. The trailing exit works seamlessly with other types of exits.

Breakeven Trailing

Once a position is taken and after a specified profit trigger is achieved, a breakeven stop can be used to protect profits and prevent a winning trade from moving against your position and turning into a loss. The breakeven stop can be set to move the stop loss to breakeven, plus or minus a specified number of ticks to cover commission or spread costs.

Dynamic Parameter Grid

Markets are dynamic and can change its behavior throughout the trading day so its very useful to be able to configure set parameters quickly and easily. A typical NinjaTrader strategy will require a strategy reset to accommodate a parameter change, however, the TrendlineProTrader supports changing parameters “on-the-fly” to keep pace with ever-changing markets.

3rd-Party Indicators

TrendlineProTrader works great with raw price action but can also work with your favorite standard or custom indicator. These might include a Moving Average, SuperTrend or Parabolic SAR to name a few.

–

Breakout Pullback

[Planned] This approach uses a two stage entry trigger. First, one of two trendlines must be broken and then subsequently recrossed before an entry is taken. There is a requirement for a minimum level of price penetration beyond the trendline as well as the price must bull back within a specified number of bars.

Preset Targets Stops

[Planned] Typically, when using NinjaTraders ChartTrader or DOM, you have to wait until a position is taken before modifying the preset profit targets and stops. The TrendlineProTrader allows visual setting of targets and stops relative to the prevailing price action before a position is taken to enable evaluation of risk / reward before the trade is taken.

Other Features

- Works on all bar-types and will trigger trendlines based on the close of the bar type.

- Market orders are used for entries, emulating a market if touched order, so you don’t have to reveal your intentions to the market.

- Can be used on all markets including equities, futures, and forex.

- Includes equity stops when max daily gain or loss is reached as well as an equity trail stop to protect profits once a specified trigger amount is achieved.

Benefits

- Enables positioning and activation of trendlines to trigger trades without the need to constantly monitor the charts.

- Improves the execution speed of placing orders where extra clicks and even fractions of a second can be detrimental.

- Still have full use of the Chart Trader functionality.

Requirements

- NinjaTrader 8 Version 22.2 or later

- Comfortable setting up own ATM strategies on the NinjaTrader 8 ChartTrader.

- Preferred broker is NinjaTrader or another CQG brokerage for live/sim usage and Kinetick for simulation if only a datafeed is available.

- Operations on Rithmic or Interactive Brokers are not supported.

- Apple devices using Windows VMs are not supported.

Resources – Books

- Getting Started in Chart Patterns / Thomas N. Bulkowski / 2005

- Channel Surfing – Riding the Waves of Channels to Profitable Trading / Michael J. Parsons / 2005

- Martin Pring on Price Patterns / Martin J. Pring / 2005

- Trading the Line – How to Use Trendlines to Spot Reversals and Ride Trends / Jeffery Kennedy / 2009

- Trend Qualification and Trading – Techniques to Identify the Best Trends to Trade / L.A. Little / 2011

Resources – Magazine Articles

- Drawing Objective Trendlines / Tom DeMark / Active Trader / Sep 2006

- Trading Trendline Breaks – Part 1 of 3 / Sylvain Vervoort / Stocks & Commodities / Jul 2007

- Trading Trendline Breaks – Part 2 of 3 / Sylvain Vervoort / Stocks & Commodities / Sep 2007

- Trading Trendline Breaks – Part 3 of 3 / Sylvain Vervoort / Stocks & Commodities / Oct 2007

Resources – Links

- Utility of Trendlines / Investopedia

- How to Use Trendline Support or Resistance to Enter a Trade / DailyFX

About

- Whitmark Development and its principal developer is an independent solution provider exclusive to the NinjaTrader platform since 2005.

- Please send any additional inquiries to info@whitmarkdevelopment.com.

Terms of Use

- The terms of the lease are governed by the End-User License Agreement (EULA). Click here to view.

- Unless otherwise expressly permitted, this indicator is for the sole use of the named licensed user for up to two devices (e.g., desktop or laptop computers).

- Preferred broker is NinjaTrader Brokerage (or other CQG enabled broker) for live and simulated usage and Kinetick for sim-only usage if only a datafeed is available.

- Apple devices using Windows VMs are not supported.

Lifetime Lease Price – $995 USD

- The lifetime lease price for the TrendlineProTrader for NT8 is $995 USD for the sole use of the lessee purchaser for up to two devices.

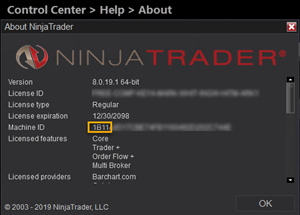

- Licensing for this product is managed by the NinjaTrader License Management system utilizing your Machine Id.

- Please enter the first 4 digits of your 32-digit Machine Id for up to two devices in the slots provided below. A second device can be added later, no problem.

RISK DISCLOSURE: Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

HYPOTHETICAL PERFORMANCE DISCLAIMER: Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. For example, the ability to withstand losses or adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

NinjaTrader is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has an affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.