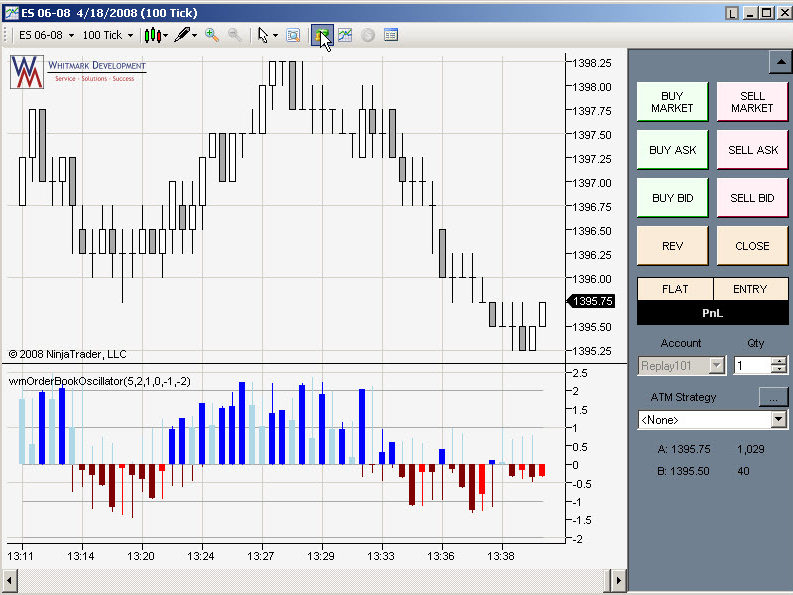

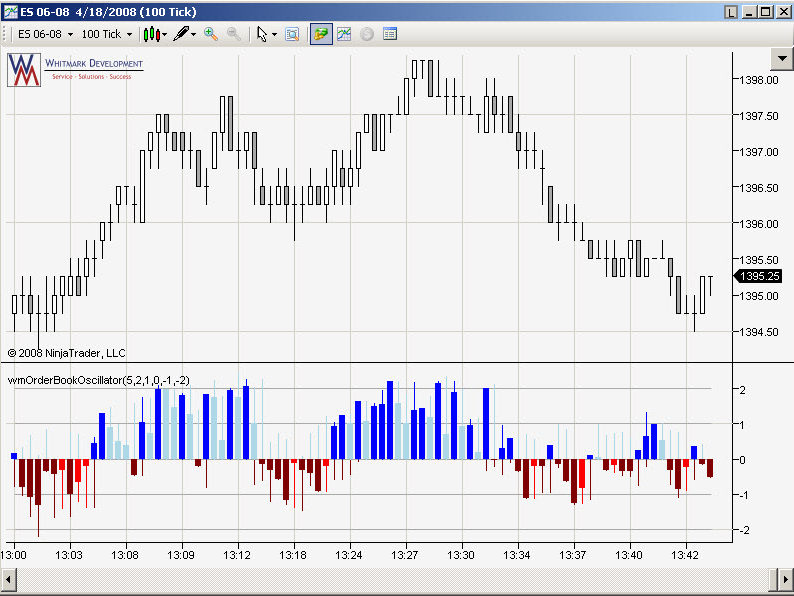

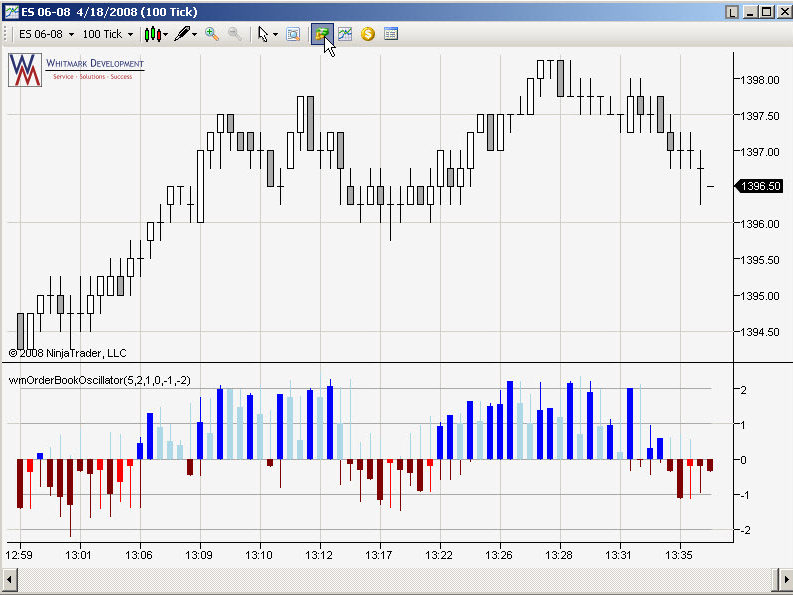

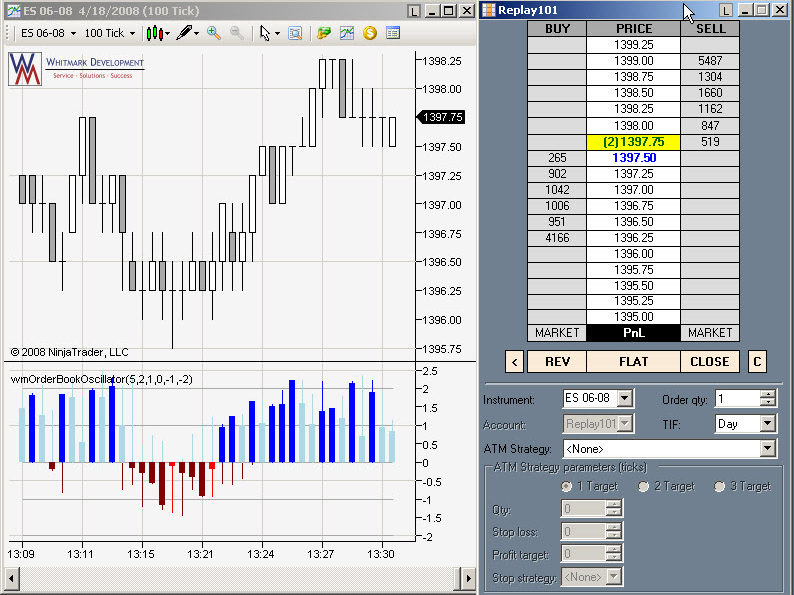

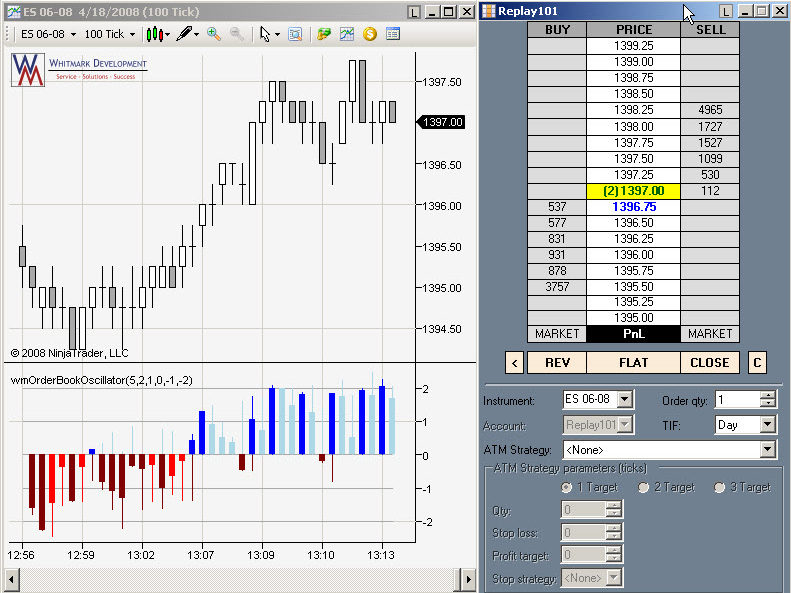

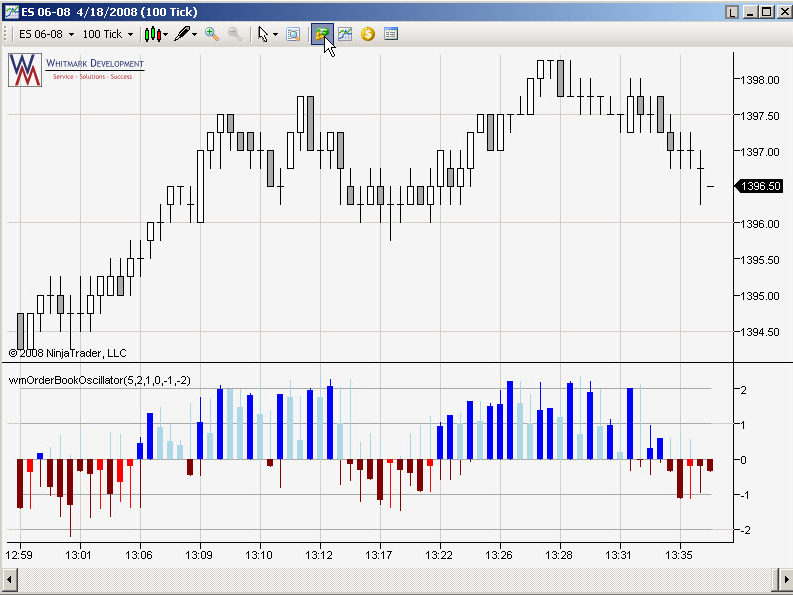

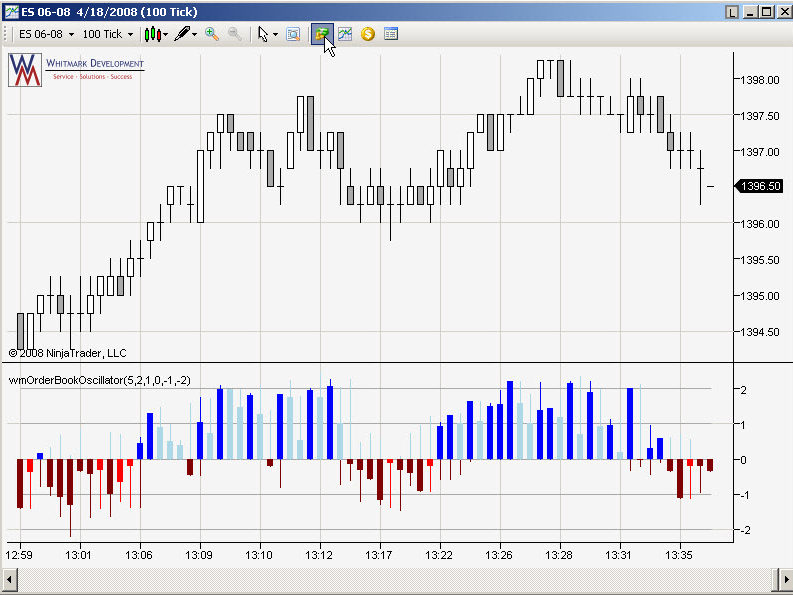

Looking for a tool beyond price action and traded volume to confirm your next trade entry? Many scalpers, myself included, use Level II depth of market order book volume as a key go/no-go filter before placing a trade. This indicator calculates order book volume cumulative bid/ask ratio in real-time and plots the values in a “candlegram” format . . . a cross between a candle and a histogram for easy identification. Similar to a candle bar, the “candlegram” wick informs you about the extreme intrabar moves in the oscillator.

Screenshots

Features

- Displays cumulative bid/ask ratio for up to five levels of the order book volume.

- Realtime indicator for use on live data or market replay.

- Candlegram bars show value at the close of bar while the wicks show intrabar extreme moves.

- Candlegram color and width attributes can be modified.

- Can be used with the NinjaTrader ChartTrader and eliminates the need to monitor and compute ratio values on the DOM.

- Extreme values can help predict market reversals.

Video

Forthcoming . . .

Usage Suggestions

- The Order Book Oscillator (OBO) is best used on small interval bars for trend or counter-trend scalp trading.

- Avoid or defer entries that do not coincide with the direction of the OBO.

- Each market and time frame will have it own characteristics so plan on spending time to observe the OBO over different market condition before trading.

- Like any oscillator, its important to focus on transitions from high extremes and momentum reversals when the oscillator crosses the zero line.

- Generally, ratio values between +/- O.5 are noise unless transitioning from an opposite extreme.

- Values between 0.5 and 2.5 indicate bias in the direction of the oscillator.

- Extreme values at values at 2.5 often suggest a price reversal is imminent.

Terms of Use

- The terms of the lease are governed by the End-User License Agreement (EULA). Click here to view.

- Unless otherwise expressly permitted, this indicator is for the sole use of the named licensed user for up to two devices (e.g., desktop or laptop computers).

- Please review the disclaimers at the bottom of the page.

Installation

- A download link with installation instructions with be sent within 24-hours after purchase.

- Requires subscription to Level II data which may be an incremental charge from your broker/data provider if not already subscribed.

Price: $95 USD

ALL SALES FINAL

Licensing for this product is managed by the NinjaTrader License Management System. To gain access to the product, you will need to cut and paste the 32-digit Machine ID that can be found from the NinjaTrader Control Center > Help > About dialog box.

Click here for additional information on finding your NinjaTrader Machine ID.

Please note, you may purchase this product without supplying the NinjaTrader Machine ID, but we will need to follow-up with you via email to obtain this information before activating the product. Please allow 24 hours for the activation from the time we receive your Machine ID.

RISK DISCLOSURE: Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

HYPOTHETICAL PERFORMANCE DISCLAIMER: Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. For example, the ability to withstand losses or adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

NinjaTrader is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has an affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.